Even after more than a decade of having to comply with the Employer Mandate portion of the Affordable Care Act (ACA), many organizations still struggle to get it right.

With shifting affordability thresholds, evolving electronic filing rules, and complex state-level requirements, it’s understandable why managing compliance with the law on your own can be difficult.

As 2026 approaches, employers must once again prepare to meet the ACA’s Employer Shared Responsibility Provisions, also known as the Employer Mandate, for the 2025 tax year.

The law requires Applicable Large Employers (ALEs) to report employee healthcare coverage accurately and on time, with steep penalties for those who miss the mark.

In this post, we offer a refresher on what’s required under the Employer Mandate, outline the key 2026 deadlines for 2025 ACA reporting, and explain how Infor CloudSuite solutions can help organizations simplify ACA compliance.

What’s Required Under ACA’s Employer Mandate?

The Employer Mandate requires ALEs, or those organizations with 50 or more full-time or full-time equivalent employees, to provide Minimum Essential Coverage that meets affordability and Minimum Value standards to at least 95% of their full-time employees and their dependents.

In addition to offering coverage to eligible employees with the aforementioned criteria, on an annual basis ALEs must:

- File 1094-C and 1095-C forms with the IRS to report employee coverage and enrollment details

- Furnish 1095-C forms to employees

- Complete additional state-level ACA filing requirements, where applicable

- Submit Form 1095-B or equivalent reporting, if offering a self-funded plan

In the official IRS 2025 instructions for Forms 1094-C and 1095-C one notable addition was made apparent; an alternate method for furnishing.

ALEs no longer have to automatically send Form 1095-C to their full-time employees, and instead can satisfy the requirement by making them available by request in a clear location on their website. We’ll discuss the details of this new alternative furnishing method later in this post.

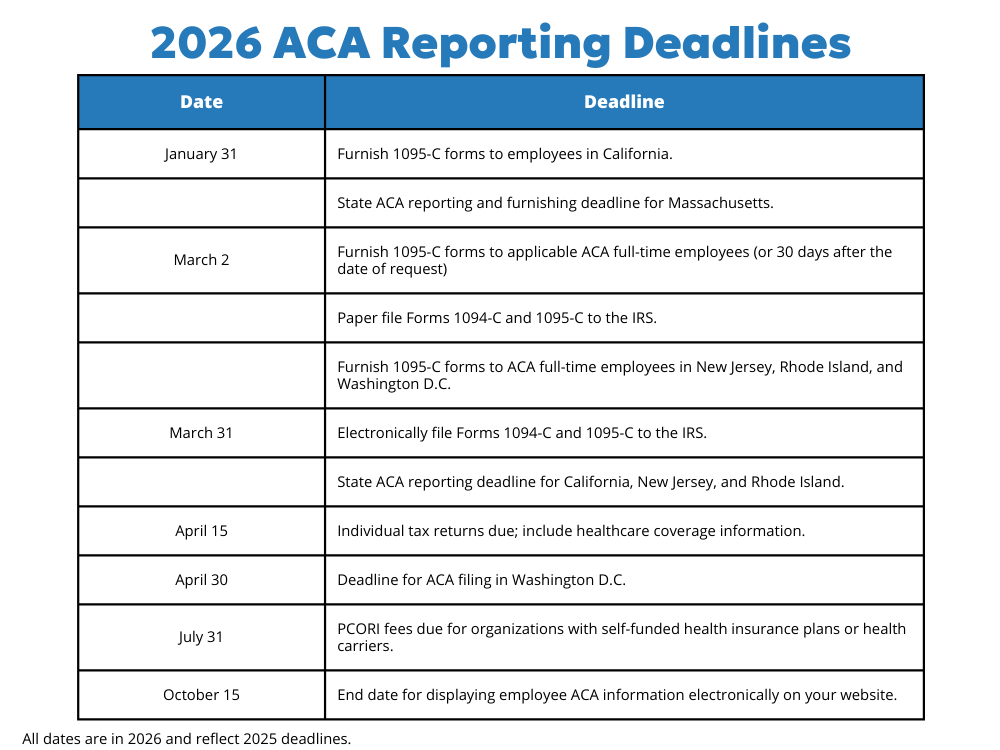

Below are the deadlines for each of the ACA reporting requirements for the 2025 tax year.

Paper Filing Deadline

Organizations eligible for paper filing must generally submit ACA Forms 1094-C and 1095-C to the IRS by February 28. This year, the 28th falls on a Saturday so organizations will gain an additional two days and submit their forms by Monday, March 2, 2026.

As a reminder, organizations may only paper file if they have 10 or fewer 1095-C forms. Businesses with more than 10 1095-C forms must file electronically via the IRS Affordable Care Act Information Returns (AIR) system.

Electronic Filing Deadline

Since most ALEs have more than 10 1095-C forms, they will need to file electronically and thus comply with the electronic filing due date.

For the 2025 tax year, the deadline to electronically submit Forms 1094-C and 1095-C to the IRS is Tuesday, March 31, 2026.

Employee Furnishing Deadline

In addition to filling applicable employee healthcare details to the IRS, organizations must also furnish 1095-C forms to their employees by March 2, 2026 or within 30 days of the employee request.

It’s important to note that under the Employer Reporting Improvement Act, organizations no longer need to furnish 1095-C information to every single employee, and instead must only make it available by request.

This applies to all states except for California, New Jersey, and Rhode Island, which have their own furnishing and reporting requirements.

As noted in the final 2025 ACA instructions, organizations may now opt for the alternative furnishing method and notify their employees of ACA information electronically, instead of physically mailing the required 1095-C information.

This simpler method greatly reduces the administrative burden on HR staff. However, teams will need to mobilize quickly to ensure clear communication is shared promptly.

Some additional requirements for the electronic furnishing method state that employers:

- May post a clear, conspicuous notice on their website stating that employees may request a copy of Form 1095-C

- Must furnish the form within 30 days of receiving a request

- Must ensure the post remains available through October 15, 2026

PCORI Fees Deadline

Employers extending self-funded health plans to their workforce must also pay the Patient-Centered Outcomes Research Institute (PCORI) fees, due Friday, July 31, 2026.

For plan years ending between September 30, 2024, and October 1, 2025, the IRS has set the fee at $3.47 per covered life, an increase from the previous year’s $3.22.

State ACA Reporting Deadlines

Beyond federal filing, five jurisdictions throughout the United States require additional state-level ACA reporting.

If your organization has even one employee residing in these states, or working remotely there, you must comply with that state’s ACA filing requirements. These deadlines generally mirror the federal March 31 electronic filing deadline but can vary slightly by state. They are as follows:

- California: Furnishing deadline: January 31, 2026. Filing deadline: March 31, 2026.

- Massachusetts: Furnishing and filing deadline: January 31, 2026.

- New Jersey: Furnishing deadline: March 2, 2026. Filing deadline: March 31, 2026

- Rhode Island: Furnishing deadline: March 2, 2026. Filing deadline: March 31, 2026

- Washington, D.C.: Furnishing deadline: March 2, 2026. Filing deadline: April 30, 2026

With so many deadlines to juggle and keep track of, we thought it best to compile them into an easy to digest graphic.

The Cost of Non-Compliance

ACA non-compliance remains one of the most expensive regulatory pitfalls for employers. Missing or incorrect filings can result in IRC 6721/6722 penalties, often communicated via IRS Letter 972CG or Letter 5005-A.

In addition, employers that fail to offer qualifying coverage may face penalties via IRS Letter 226J, tied to 4980H(a) and 4980H(b) of the Internal Revenue Code.

Because the IRS no longer offers “good-faith relief” for reporting errors, even small mistakes can be costly and there is no statute of limitations on ACA penalties.

Get Help with ACA Reporting

Compliance doesn’t stop once forms are filed. January 1, 2026, marks the beginning of a new ACA reporting year with updated affordability requirements.

For 2026, the ACA affordability threshold is 9.96%, up significantly from 9.02% in 2025. That means employers must ensure employee healthcare contributions do not exceed 9.96% of an employee’s income, using one of the IRS safe harbors—W-2, Rate of Pay, or Federal Poverty Line (FPL).

RPI Consultants can help you configure affordability settings in Infor’s Benefits module, manage eligibility determination, and ensure accurate offer tracking and reporting to maintain compliance.

Even after 10 years, ACA reporting remains a complex, evolving requirement for employers. Infor CloudSuite’s Benefits Module within CloudSuite GHR helps simplify this process by:

- Tracking employee eligibility and coverage elections

- Managing benefit costs and affordability thresholds

- Automating 1095-C generation and electronic submission

With the right configuration, you can reduce manual data entry, minimize compliance risk, and stay ahead of shifting ACA requirements.

If your organization needs assistance preparing for the 2026 ACA reporting deadlines, reach out to RPI Consultants. We can help ensure your Infor environment is ready for a smooth and compliant filing season.

For more insights on ACA compliance and Infor benefits, check out the RPI Tech Connect podcast below, featuring ADP’s Wendy Delgado-King.

2026 ACA Reporting FAQ

1. What are the 2026 ACA reporting deadlines for the 2025 tax year?

For the 2025 tax year (filed in 2026), key deadlines include: employee furnishing by March 2, 2026, IRS paper filing by March 2, 2026 (since Feb. 28 falls on a Saturday), IRS electronic filing by March 31, 2026, and the PCORI fee due July 31, 2026. Some states have different deadlines, so multi-state employers should confirm state requirements.

2. Who must comply with ACA’s Employer Mandate and file Forms 1094-C and 1095-C?

Applicable Large Employers (ALEs), generally those with 50 or more full-time or full-time equivalent employees, must offer Minimum Essential Coverage that meets affordability and Minimum Value standards to at least 95% of full-time employees and dependents, and report coverage annually using Forms 1094-C and 1095-C.

3. When is electronic filing required for 2026 ACA reporting?

Employers with more than 10 Forms 1095-C must file electronically through the IRS AIR system. For the 2025 tax year, the electronic filing deadline is March 31, 2026.

4. Do employers still have to mail Form 1095-C to every employee?

Not always. Employers may satisfy the furnishing requirement by making Form 1095-C available upon request and providing clear notice, rather than automatically sending it to every full-time employee. However, some states have separate furnishing rules, including California, New Jersey, and Rhode Island.

5. What is the ACA affordability threshold for 2026, and why does it matter?

For 2026, the ACA affordability threshold is 9.96% (up from 9.02% in 2025). Employers must ensure employee contributions for coverage do not exceed that percentage of income using an IRS safe harbor method (W-2, Rate of Pay, or Federal Poverty Line) to help avoid Employer Shared Responsibility penalties.