Keith Wayland:

Hi, let’s go ahead and get started. Once again, my name’s Keith Wayland. I wanna thank you for taking the time to join this webinar on AP Automation with Kofax TotalAgility and Infor Lawson APIA.

We’ve actually been automating AP departments and AP solutions for over 15 years, and more recently we’ve had a lot of experience leveraging Infor Lawson’s delivered approval module with Kofax TotalAgility to develop cost effective solutions for invoice data capture and routing approval. We think this is a really good combination.

Two wonderful presenters for you here today. Mr. Ben Nichols, Mr. Alex Lindsey and I’m gonna hand off to them in just a second. First I have a couple of housekeeping items. One is we will be taking questions throughout the presentation. Michael Hopkins will ask them as they come up. They love hard, challenging questions so please lay them on us. Also, we will be recording this session. It takes us a few days to get it rendered and uploaded, but once we do we will send you a link so that you can re-watch and share.

With that, I give you Alex and Ben.

Alex Lindsey:

Thank you, Keith, very much for that introduction. Like you said, we are going to talk about AP Automation with Kofax TotalAgility, which is Kofax TotalAgility and Infor Lawson APIA. One note of business here. We do have another team, the Content Process Automation team is going to be doing another webinar. Ben and I are going to be talking about content management with Infor Lawson at 2pm Eastern Standard Time, 1pm Central Standard Time. And there are a plethora of other Lawson webinars going on today as well and we really encourage you to go check those out and sign up for ones that you guys may want to learn about.

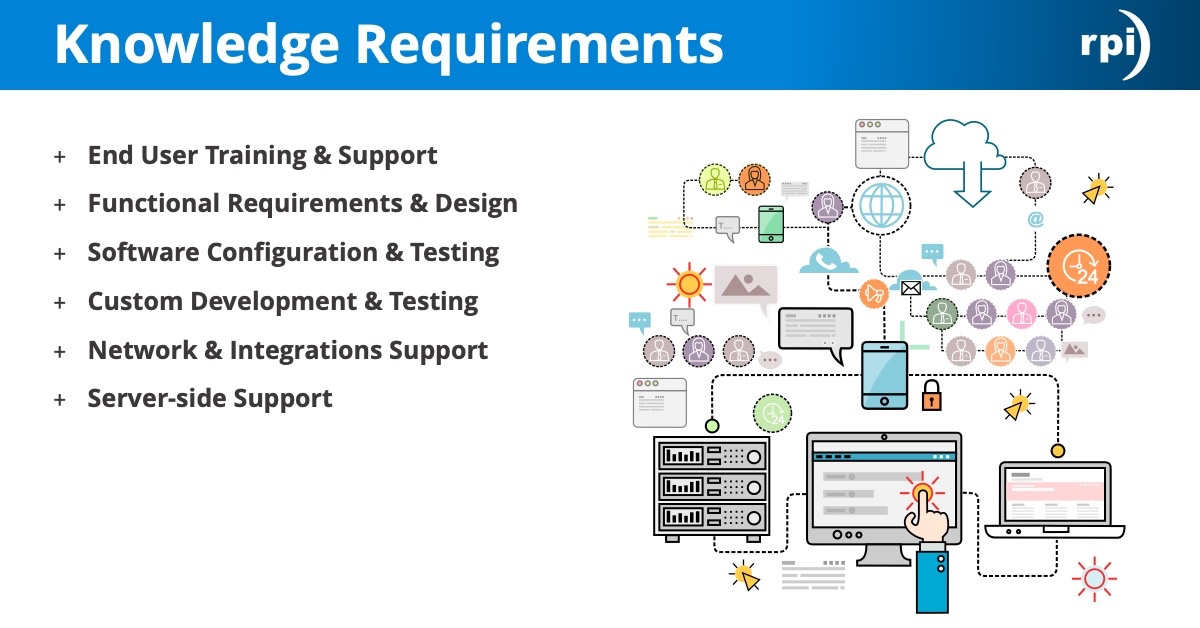

For the CPA team, we are actually taking a quick break in January and we’ll be back with a bunch of other content filled webinars in February. To get us started, my name is Alex Lindsey. I’m a senior solutions architect with RPI Consultants. I have been working in the ECM Enterprise Content Management in the AP Automation space for a very long time. I like to design very weird solutions and I’m also a whiskey distiller.

Ben Nichols:

And I’m Ben Nichols. I’ve been working with RPI for a while now and I have four plus years’ experience in designing, scoping out, and creating custom solutions accommodating for a wide variety of both best practice solutions and custom business processes. But typically I focus on the realm of AP and process automation with inside of finance.

So a little bit more about our agenda today. We’re gonna be talking a little bit about RPI first. Then we’re gonna chat about Kofax TotalAgility, Lawson APIA, integrated solutions, and then we’ll wrap up with some summary and questions.

Alex Lindsey:

So a little bit about RPI Consultants. We have 80 full time consultants, project managers, the smartest people you can think of all sit out there and they’re way smarter than me. I just try to keep up. We also have offices located in Baltimore, where we are broadcasting from today, Tampa, as well as Kansas City where Ben and I hail from. If you guys are looking for solution support with Infor Lawson in particular, but we also are partnered up with Hyland for the OnBase/Perceptive software, Brainware software sphere, as well as Kofax. And that includes ReadSoft Online and things like that, as well.

We are also an authorized service provider and licensed reseller for Kofax products. Like I mentioned, that’s Kofax TotalAgility which we’ll talk about today a little bit more in depth, KTM, Kofax Capture, Kapow, as well as ReadSoft which I’m kind of a big fan of, as well. If you guys are looking for health checks, implementations, or just a quick chat about any of these, we’d be happy to help you out.

Ben Nichols:

Next up, we’re also a certified Infor Lawson alliance partner. We specialize in industries that include healthcare, public sector, commercial business, as well as a wide variety of additional industries. A lot of our solution expertise focuses on the financials realm, which includes AP and financial process automation. We also have great expertise with inside of human resources, supply chain management, version 11 CloudSuite. We know a lot of customers, that’s a prospect in their future, so we definitely have some experience in that realm. We also have knowledge within payroll and technical services with Infor products.

Alex Lindsey:

All right, so kind of jumping into it. How can we automate your invoice processing if you’re an Infor customer? One of the big ways we’d like to do this and one of the things that our team does really well is introducing some OCR technology. And this is where Kofax TotalAgility comes into play.

First off, Kofax TotalAgility at its core it’s a very robust and powerful workflow engine. Within that, you have the ability to do data extraction. So intelligent content and data capture. That means that we can pull details and values off of your electronic documents or scanned documents. It’s also a great tool for managing sometimes approvals, case managements for insurance claims and things like that, buyer reviews, packing slip extraction as well for PO documents and things like that.

Then AP and IP agility for Kofax TotalAgility is what we’ll really be focusing on today and that has to do with your invoice processing and data capture from there.

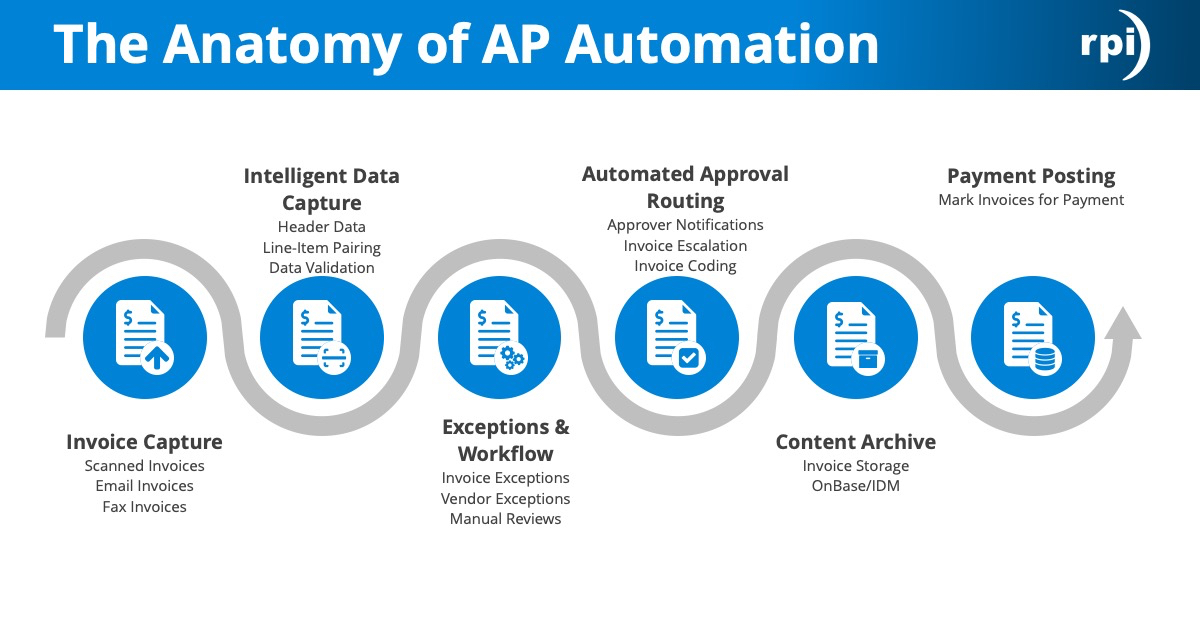

So what is the AP/IP agility? It’s invoice processing and accounts payroll processing. Essentially we streamlined capture. So if you have documents, your invoice documents, you probably have multiple ways that those are coming in. That could be EDI sometimes but most of the time it’s gonna be paper or email. There may again be a vendor portal that you have to download it from. Either way, we’d like to streamline the capture of your invoice documents into Kofax itself, into Kofax TotalAgility.

We have basically, a lot of times if you don’t have a front end OCR, we like to encourage our clients to streamline that. So work with your suppliers to basically say, “Please just send your invoices to this email address or to this location.” That way you can streamline that in.

After you capture your invoice documents, again this is something that we’d like to automate so no one really has to touch it yet, it goes into the extraction process. At this point, Kofax TotalAgility is built to basically read through all of your invoice documents. All the invoices that come in, it’s gonna try to pull values off of that and validate that against your ERP, against Infor Lawson.

If for some reason it has to stop, if it’s not confident in certain things, there will be a user verification, which I’ll talk about as well. Then after that, that data that we’ve extracted along with the document itself gets exported over to APIA for further handling.

So what does the data extraction and validation kind of look like? Essentially we’re pulling invoice header and line details. So if you have non-PO invoices we’re gonna get that header information. What that kind of looks like from a technical, slightly technical standpoint is that it’s gonna look for invoice number, invoice date, invoice amount, it can pull any value that’s on the document itself you can basically train Kofax TotalAgility to pull that information. It’s also going to try to find your supplier information. If you have a PO on the invoice for instance, that’s typically tied to your vendor information, your supplier information, so we can logically make that assumption and make that connection with the data itself.

If it’s not, if you don’t have a purchase order number on your invoice document, we can look at the address and match that up against your supplier master within Infor, as well. At that point it’s doing all this on the back end. Your users aren’t doing anything yet. It’s pulling these values and it’s making logical conclusions as to what this information is based on where it is on the document and where it needs to go into APIA.

Like I mentioned, if it does need to stop for any reason, that’s typically…it could be a number of different reasons. It could be image quality, so if the image itself is garbage or if it’s a yellow piece of paper or something like that. That sometimes happens and it could require a user intervention. There is a nice web based user interface for these people to do that. So basically your AP clerks or your AP analysts will go in and select values that need to be corrected.

Other instances could be if the vendor is not set up yet, if the purchase order you could have validations in place to stop it if there’s not enough money on the purchase order. So it actually can’t be posted yet anyway. These are the type of validations that could be set up within Kofax TotalAgility to stop it before it gets any further in the process, before you actually get to APIA and do the posting.

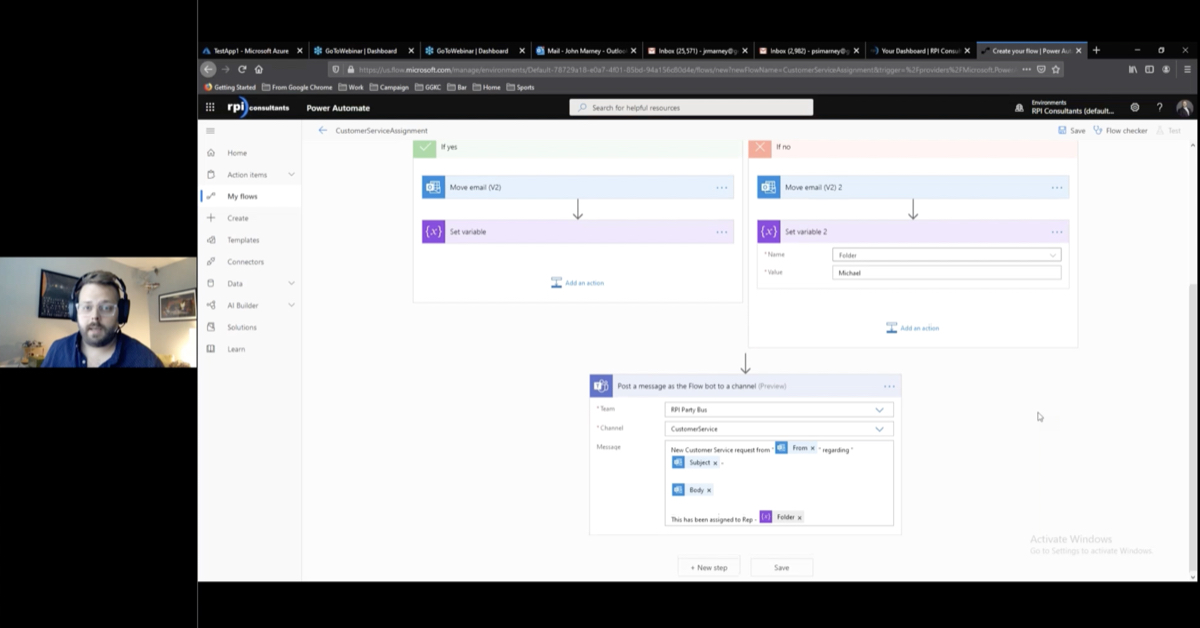

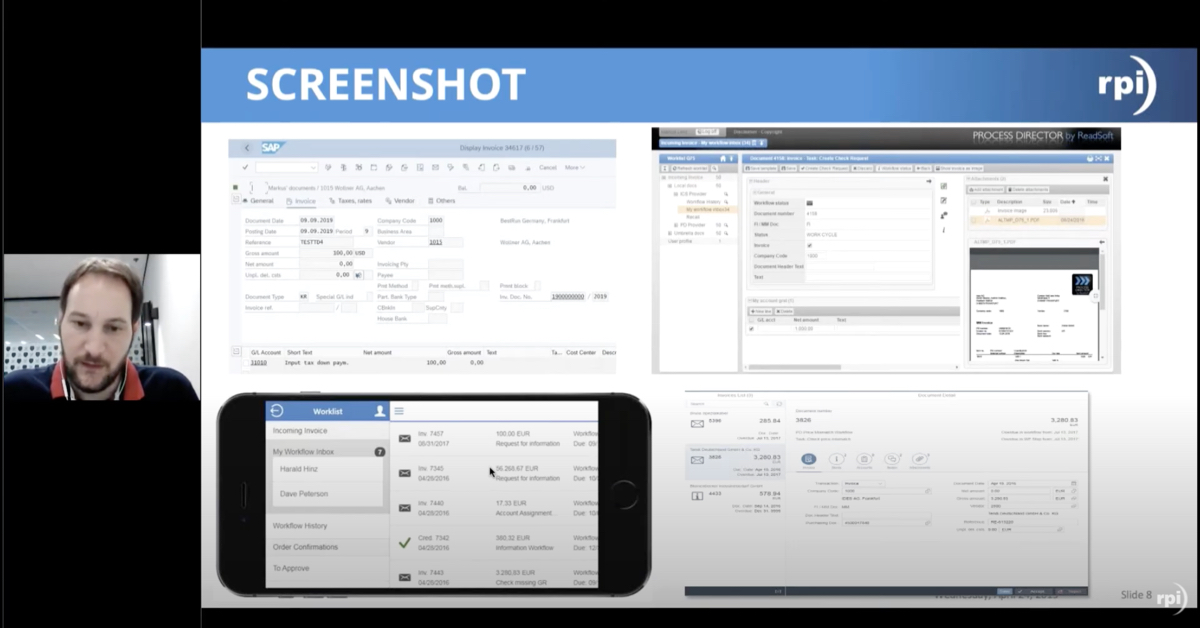

You can see here we’ve got a number of different fields, so this is a nice little screen shot of what Kofax TotalAgility IP agility looks like. Again you’ve got your image here and you’ve got these kind of indications that hey I need to update this value, I need to update this value. Within this as well you can actually do dynamic searches within Infor. So we basically get master data from Infor into Kofax TotalAgility so that when you need to make a reference or you need to make an adjustment to process this invoice forward, you know that it’s coming from your source of truth.

After, and again those look ups can be with an API, it can be an ODBC connection to connect directly to a database, or it can be just static data. If you have some one-off items that’s specific to your instance of Infor and you just wanna have that included to maybe make some routing or logic decisions downstream, you can do that as well.

After that it’s then exported over to APIA where you’re gonna be handling a lot of your geo-coding and approvals. And Ben’s gonna really be talking about that. The way we do that by the way is typically through Yoga Connects. That is our ingrown or our in house tool that we’ve built to basically handle web service calls in between Infor Lawson and other systems.

Ben Nichols:

All right, so we’re gonna switch over now and talk about where that data goes after it’s been exported, so we’ll be chatting about Infor Lawson accounts payable, invoice automation, which is what we refer to as APIA. What APIA is, is a Landmark-based application within the Lawson platform and what its primary goal is to pull in both the ability to enter invoices, validate that the information is there that you need for approvals, and do some data verification. Then it’s ultimately an approval matrix management system.

It houses your approval matrix and the routing roles associated with getting an invoice out to the correct approvers. It also has the ability to do automation for those approvals and so it can auto assign the approval routes and then also auto approve certain invoices. For example like a PO, you’ve already got an approval, we don’t need to go through another approval process for that so it can switch over.

Why APIA? The selling point with APIA really is the fact that it is a direct invoice processing system inside of the Lawson platform. No longer are you reliant entirely on a third party application to get invoices entered, processed, and sent out for approvals. The other great benefit about it is the fact that it has direct access and real time access to Lawson’s financial data. For example, in a drop down on an invoice entry screen for a company, you are pulling straight from the Lawson financial data tables or for your vendor, you’re pulling directly from the vendor records. So there is no lag time, there is no outdated data in there. It’s all real time to what’s in your Lawson financial system.

Additionally, it simplifies your upgrade and your maintenance. Specifically APIA began inside of version nine and version 10, it is also available with inside of version 11. It changes a little bit in naming and becomes AP Automation. But all of the same business classes in version nine and version 10 are the exact same business classes that are in version 11. So that upgrade path and that maintenance path long-term is a very accessible and a lot more reasonable than full re-implementations or full re-configurations.

Additionally, because the way APIA is set up and the way third party applications have kind of filled in the gaps over the years without this direct integration to Lawson, it now helps minimize the third party application footprint and additionally support and sometimes licensing cost. It’s very dependent on each businesses solution and their setup currently, but it does have the ability to minimize that cost.

Real quick we’re gonna take a look at a kind of out-of-the-box process flow. We’ll start up top here which is our ECM and OCR solution. In this instance we’re talking about Kofax TotalAgility and that is actually gonna be our OCR aspect of it. You’d typically have some kind of ECM bolted up, too to store your documents. But we’ll go ahead and look at capturing the invoice, getting the basic header level and detail level information from OCR, Kofax TotalAgility in this example. Then we’ll be passing it through web services to create that invoice with inside of APIA.

That’s where our Yoga Connect connector, our in-house software actually helps us assist in getting that data over to Infor Lawson. We then collect any remaining data necessary in order to send the invoice for approvals. We check for required data, we send it through the approval process, and it references all the configurations of your approval matrix and who and what should route where. At that point, we’ve sent it out, we either get an approval or a rejection on the invoice. If approved, we jump down to the next swim lane. If rejected, we actually have some additional processes for our AP invoice processors. They can handle and review the invoice and get it ready to go back out for approval and complete the invoice life cycle.

But once we have a fully approved invoice, we then are sent over to the ERP. This would be Lawson financials and these two exist inside of the same platform, so this is a Lawson environment. This is where we interface the rest of the data in for the remainder of your processes, whether that’s check processing, month end closing, reporting, things like that. It still goes back into your core financial, Lawson financial applications and processes and API exists just to structure and handle the approval process.

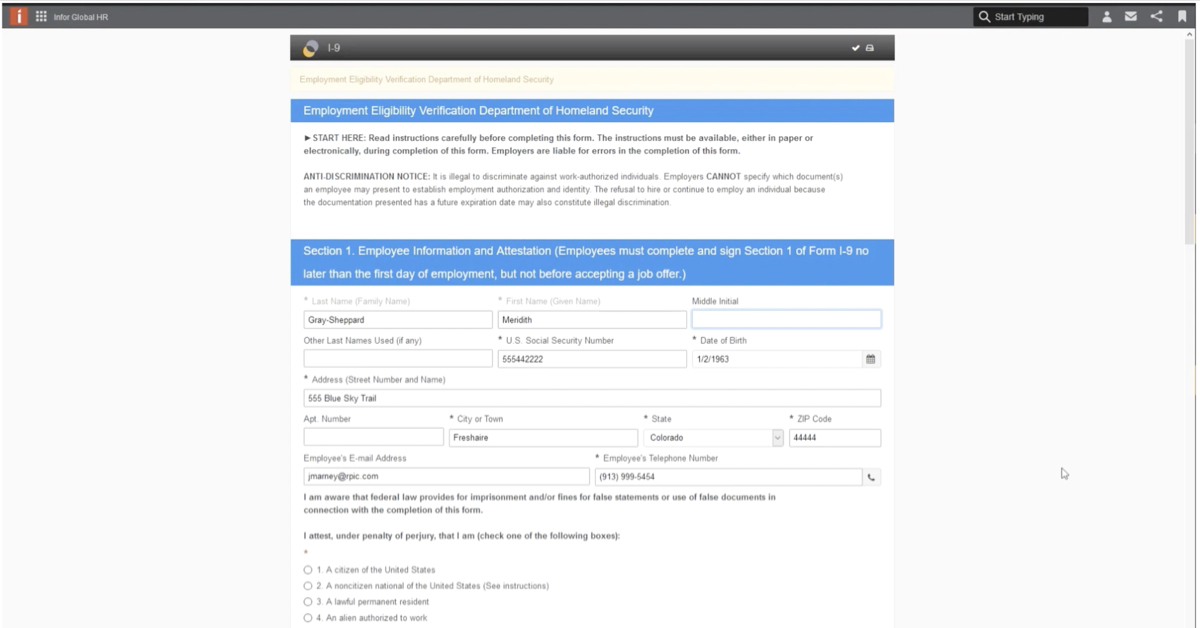

Availability as we discussed, API is available with inside of Lawson version nine and version 10. Then AP Automation, which is the same kind of platform, same technology, is available with inside of version 11. We’ve had a lot of customers lately talking about version 11. There’s a lot of excitement about it and a lot of questions concerning what that migration and upgrade path looks like. But it’s, again, built on the same business classes, has a very similar look and feel which we’ll take a look at here in a second, and then we’ve got a very similar core status. Which inside of APIA and AP Automation, we use statuses to define where the invoice is with inside of the life cycle.

What we’ll see here is an image and an example of AP Automation with inside of version 11. Just to pique curiosity, this is what it’s gonna look like in the future for AP Automation. You can see the statuses I was referencing so we can look at the status of an invoice from an unassigned state to an unsubmitted, pending approval, approved unreleased, and several other categories. This helps the processors and those with inside of Lawson to actually see where the invoice is at.

Additionally, there are ways and we’ll talk about this a little bit more later in the afternoon, where you can see how your approvers can see the invoice through the life cycle and what status it’s in.

Alex Lindsey:

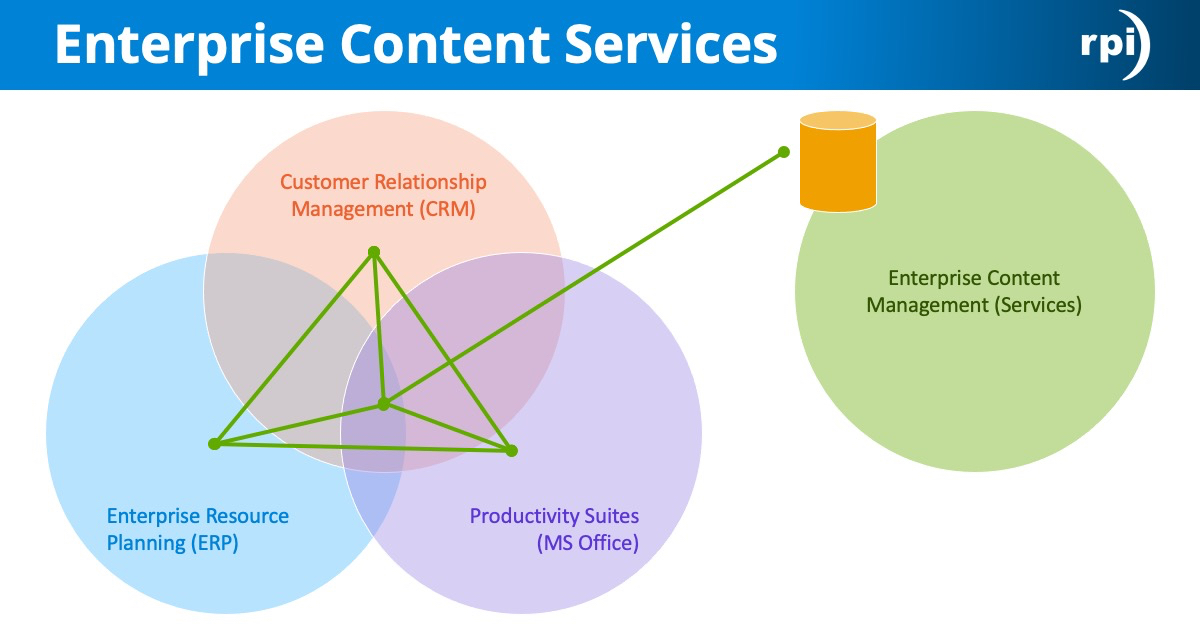

All right, so shifting gears a little bit to more the integrated solutions and how you can complete the invoice document lifecycle by incorporating kind of an ECM storage capability. ECM, we talk about it a lot on the CPA side, but how can you kind of integrate that within this kind of solution that we’re kind of showing here?

Essentially you do have a lot of the end to end AP/IP automation. You’ve got your invoice capture. The point that you receive the actual document itself. It goes to through the extraction process here where we’re actually pulling data and we’re validating that information against Infor Lawson. It then moves into your invoice approval routing and geo coding and that’s gonna happen within APIA. At that point, once it’s done with APIA again, it’s really nice that it’s seamless so there’s no extra hand-off it just exists within Infor. Your invoice gets posted. Your data gets posted. Then your payment processing happens on the back end.

So what does that mean in terms of an integrated solution within the ECM? At that point, that document, we can do whatever we need to do with it. You get the document within Kofax TotalAgility, you can archive it early to an OnBase or an ECM. We’ll talk a little bit more about that in our next webinar, Infor has an option as well for document storage. There’s a plethora of others. Main point being that we can basically get that document to wherever it needs to go.

One thing that we do a lot with a lot of our AP Automation solutions as well so you have clear line of sight with your documents, you can embed links within Lawson to basically have links to those documents themselves. We also like to update that document metadata with payment information. If you’re in accounts payable, you probably get a lot of questions about, “Hey where’s my check? Where’s my money?” This allows your users to actually go in and find the document itself and see when it was paid, the check number, the check amount, when it was sent, anything you wanted to store on that document in the ECM, you can do that as well.

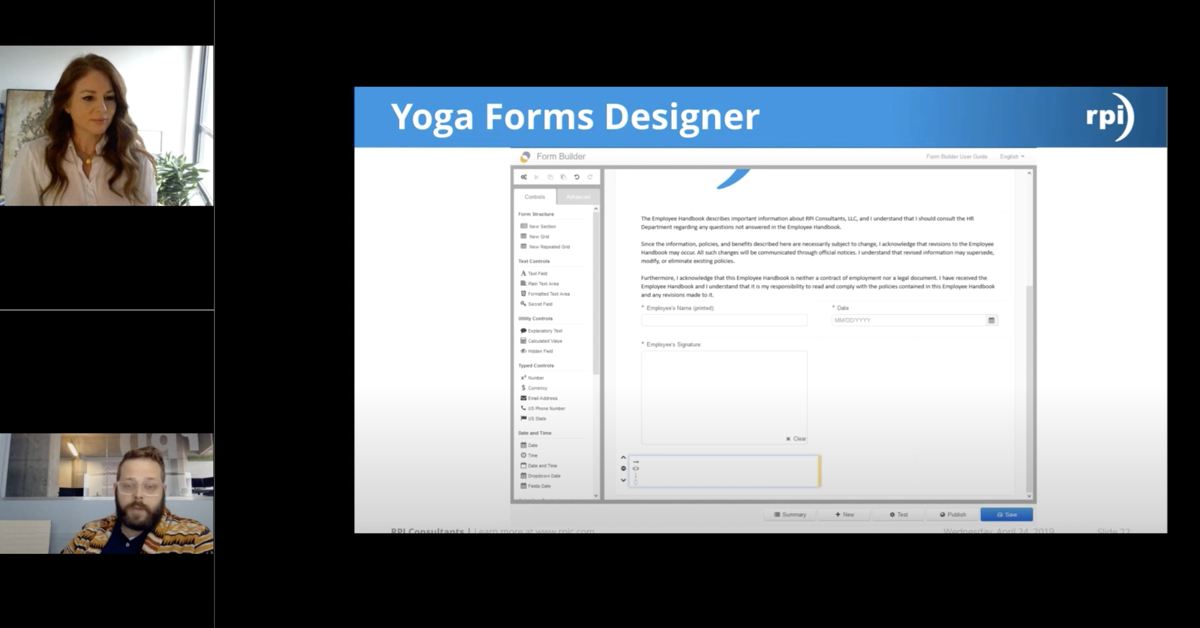

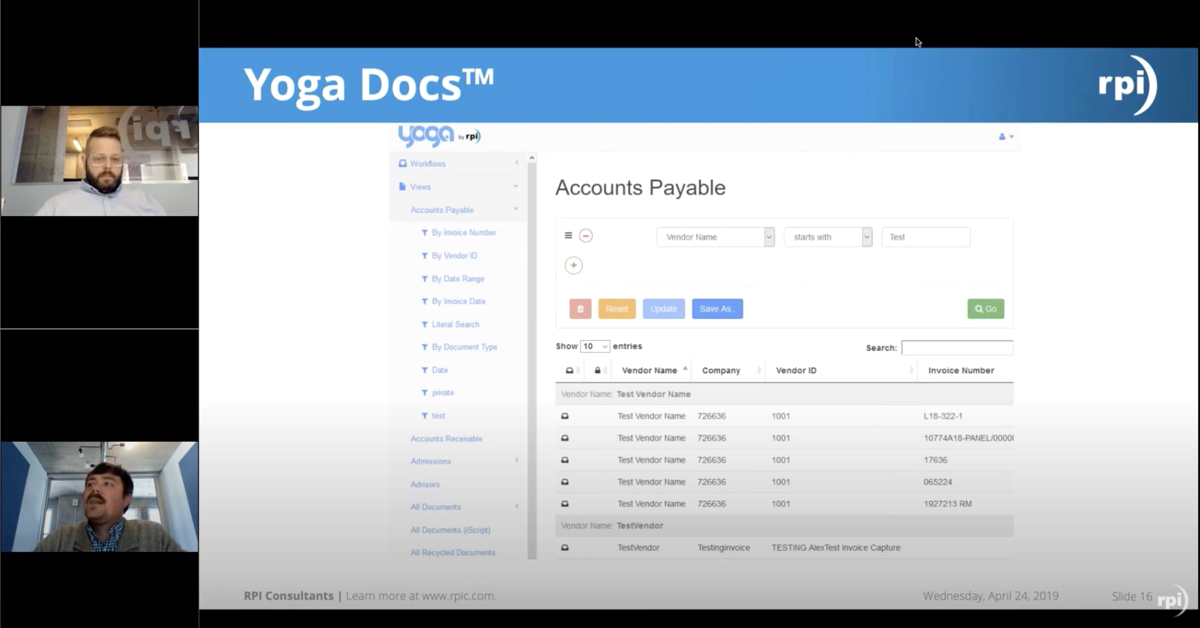

A few other additional products and integrations. Like I mentioned, we’ve got OnBase and Perceptive Content by Hyland. Those are the ones that we most frequently work with in the ECM space. If you’re looking to expand some of the ECM pieces as well, and we’ll talk a little bit more about this, we’ve got other in house products that we’ve built. Yoga Docs and Dashboard is great for actually viewing documents from an HTML five browser, so tablets, smartphones, any web browser really. There’s a dashboard along with that as well to actually provide reporting capabilities if you want. That can be approval reports. It just gives a really nice interface for your users to view documents and understand the data.

Yoga Capture, if you want to capture directly to an ECM, Yoga Capture is a tool that we’ve built as well for email capture, scanning, importing, things like that. Yoga SMS, so we talk about approvals a little bit. Yoga SMS can actually be integrated with the APIA. That essentially means that as part of your approval process if you’ve got C level people that need to…your execs and VPs and things like that that need to approve invoices but they aren’t necessarily in the system all the time, Yoga SMS can be used to actually text them a copy of the document with instructions, say hey approve or reject this invoice.

And of course like we mentioned earlier, Yoga Connect for Lawson to handle that API or those web service calls between the systems.

In summary I hope that gives you guys a great idea of how you can leverage your existing Infor Lawson to basically bolster up your financials. Front end with Kofax TotalAgility to OCR to get the data out of there, push it over to APIA so you can get the approvals. Really what that allows you to do is reduce that manual key entry that your users may be doing right now. Thank you guys very much and we’ll open it up for questions now.

Ben Nichols:

Yeah.

Michael Hopkins:

All right guys, first question. Sorry, excuse me. Do I have to use these solutions together or can I use them separately?

Alex Lindsey:

No, you do not have to use them together. If you want, you could do just APIA. If you’ve got a good process in place to get your documents in to APIA, then you could just do that. It’s not a one or the other kind of thing. You could definitely do your coding and approvals in an APIA.

Ben Nichols:

Very much so.

Alex Lindsey:

We have plenty of clients that are doing that as well. On the other end, if you’re a client and really it comes down to that manual data entry that’s really killing the productivity, you can just front end with Kofax TotalAgility and just OCR and extract invoice data, have them simply verify information and then have that actually be pushed directly into your Infor financials instead of going through APIA as well.

Ben Nichols:

Yep.

Michael Hopkins:

If I have Lawson, how long does it take to implement APIA or Kofax?

Ben Nichols:

So typically from an APIA standpoint it’s around the three to four month timeline. It’s very dependent on how engaged we are and basically how engaged our customer is with us and how proactive we are in the timeline and how aggressive we are. But you can sometimes see that range down to a two month time-frame depending on the solution, but it’s just kind of a good base to start with a three to four month expectation.

Alex Lindsey:

Kofax TotalAgility period much mirrors that, as well. There’s a little bit more data hand-off and integration with Kofax TotalAgility ’cause we need to get that data from Infor into the system itself. But it’s about the same. If you were to do these together, those would run in tandem essentially. Ben and I are working on a similar project together right now where he’s handling the APIA and I’m handling the front end OCR pieces.

Keith Wayland:

All right. I think that’s all the questions we got. I wanna thank Mr. Ben Nichols, Mr. Alex Lindsey for this presentation, all of you for attending, and I wanna point out that they will be back here in possibly an hour and a half talking about content management with Lawson. So, if you enjoyed that, hopefully you’ll join us then and I can promise that we’ll hear about Alex’s latest week varietals. So please do join us then.

Alex Lindsey:

Thank you.

Keith Wayland:

Thank you.